Economic commentary: KOJI FUSA

Koji Fusa is a prominent Japanese co-founder of the fintech unicorn GVE, which specializes in digital fiat currency platforms, including multi-central bank digital currency (CBDC) solutions. The company achieved a valuation of 224 billion yen (about 1.5 billion USD at the time) by early 2022. Its other co-founder is Susumu Kusakabe, known as the “Godfather” of NFC technology. In addition, Koji Fusa is a professor at the Aston University, Birmingham, England.

Besides Koji Fusa, the book “The Digital Money Wars” has two additional co-authors: Koichiro Tokuoka and Nicholas Edwards. The former is an expert in human resource management and leadership, and also professor at the Tama Graduate School of Business, Tokyo, Japan. The latter is a member of the GVE Advisory board.

Overview of the book

“The Digital Money Wars” was originally published in Japanese in 2021 by CrossMedia Publishing. An English version appeared later that same year, released exclusively in digital format. Therefore, the book was completed during the COVID-19 pandemic, a period marked by rapid acceleration of digitalization and a global shift toward contactless transactions, both driven by pandemic-related restrictions and behavioral changes.

The concept of digital money remains theoretically undefined, reflecting the ongoing evolution of the digitalization of money, which the authors identify as a foundational element of the digitalization of society as a whole. The term digital money is a broad umbrella term encompassing everything from the digital currency in bank accounts that facilitates cashless payments to newer, blockchain-based forms like cryptocurrencies (Bitcoin), stablecoins as well as emerging central bank digital currencies. In their view, the development of digital money must be guided by a clear long-term vision and an understanding of consumer needs. The potential advantages are significant, particularly in reducing the costs of payment transactions and mitigating environmental impacts associated with the physical transport of cash and the production of plastic payment cards.

A country that aspires to be a hegemon in the world needs to control money flows and support innovative technologies. The book finds that in today’s world, the USA and China represent two hegemons, who, although within different socio-political arrangements, recognize the same thing – that the cooperation of the private sector and the government is necessary in supporting the development of innovative technologies. The development of digital money, as well as the digitization process in general, represents more than a technological race, it represents a battle for the adoption of artificial intelligence and quantum computing, where security should be raised to the highest national level. Cyber-attacks, which can be sponsored even by some states, can cause great damage to national and even international financial and other crucial infrastructure. Moreover, the arrival of quantum computing much more powerful than existing supercomputers requires the development and application of even more advanced security systems than existing ones.

In discussing the ongoing digitalization of money and society as a whole, the authors emphasize the importance of the Four Ss: scenario thinking, speed, science and security. This is an interesting and dynamic approach to shaping the future of payments and the wider digital transformation.

The authors describe innovation leadership as a virtue that involves not only making swift decisions based on science-based analysis, but also discerning which rules to break and how. These reflections are quite reminiscent of Schumpeter’s concept of creative destruction, the disruptive process at the core of capitalist progress that renders outdated structures obsolete in favor of bold new innovations.

Diverging paths in digital money

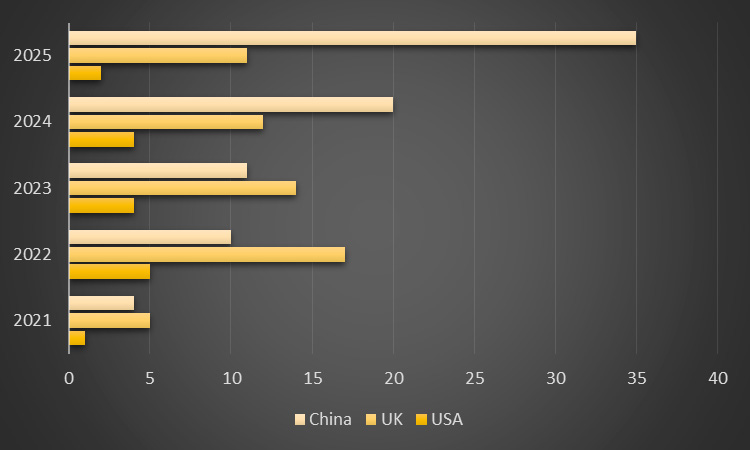

What stands out as particularly interesting is the authors’ prediction that, over the next 30 years, money will become fully digitized, taking the form of cryptocurrencies and CBDCs. When examining the comparative data from Chainalysis’s annual Global Crypto Adoption Index (see Figure: Global Crypto Adoption Index, 2021–2025), a clear divergence emerges among the major powers: the United States is embracing more decentralized cryptocurrencies, while China is moving away from them. Namely, China is advancing its own CBDC (the e-CNY) while having banned nearly all private cryptocurrencies and stablecoins in 2021. In contrast, the USA has halted work on a retail CBDC and is now supporting private digital money through regulatory frameworks.

In conclusion, the authors’ core prediction appears to be materializing steadily, just as they foresaw. The two hegemons are indeed acting as forerunners in the two competing models of digital money: China advancing its state-controlled CBDC (the e-CNY) while banning nearly all private cryptocurrencies and stablecoins, and the USA supporting regulated private cryptocurrencies and stablecoins after halting work on a retail CBDC. Of course, this field is evolving rapidly and today’s policy directions may shift in the years ahead: the USA could resume exploration of a CBDC if circumstances change, just as China might ease its restrictions on private digital assets, reshaping the global balance once again.

(December, 2025)

Figure: Global Crypto Adoption Index, 2021 – 2025

Note: Lower numerical rank indicates a higher level of adoption. Data source: Chainalysis