ECONOMIC COMMENTARY:

IRVING FISHER

The book “Booms and Depressions: Some First Principles” was published in 1932 (here is a 2011 reprint). Who can better analyze business cycles than Irving Fisher, who faced financial losses and a decline in reputation after claiming, just a few days before the financial crash of 1929, that prices would remain high. Fisher has regained his reputation, and his book confirms that there is no better teacher than history.

Fisher outlines nine major forces that shape the cyclical pattern of recessions in the USA during the years 1837, 1857, 1873, 1893, and 1929: over-indebtedness, volume of currency, price levels, net worth, profits, production, psychology, velocity of circulation, and interest rates. These factors are intertwined. The shocks resulting from over-indebtedness, which lead to banks resolving debts through distressed selling, further impact the reduction of circulating money and the general price level. This, in turn, influences the growth of the real value of outstanding debt, along with the decline in net worth and profits (interestingly, Fisher observes that the application of innovative technology can effectively reduce costs and preserve profits).

Subsequently, a decrease in profits leads companies to reduce production and lay off workers. The decreased purchasing power of the population further contributes to a decline in both demand and supply. Pessimism pervades: ”During depressions, the sober judgment of many people gives way to overestimates of the severity and permanence of “hard times”” (p. 48). In such conditions, there is a general tendency to postpone spending, opting to save more, thereby slowing down the circulation of money. Real interest rates rise, albeit unevenly, as concerned creditors show less confidence toward riskier debtors or investments.

As problems arise from over-indebtedness, Fisher analyzes two types of borrowing. Unproductive borrowing, which occurs due to the necessity for financial support during periods of income disruption caused by events like droughts, earthquakes, infections, and similar occurrences (excluding war), does not pose a problem. The issue always arises from productive borrowing aimed at investing in new projects expected to yield substantial profits. The pursuit of significant profits based on minimal investment drives many individuals to invest in schemes they mostly recognize by name only (as cited by Fisher, examples include the Mississippi Bubble and the South Sea Bubble of the 18th century, along with the crises of 1819, 1837, 1857, 1873, 1893 and 1929).

Furthermore, “the world has suffered also from many great paper inflations, especially in war times. These inflations all led to debt over-extension, which has there-upon set in motion the eight other cyclical tendencies” (p. 64). Indeed, a war is always a challenge for the stability of money, as it is accompanied by war debts, inflation during and after the war. Temporarily, war can be delayed by restoring the balance of power. However, sooner or later, this equilibrium is disrupted, to the detriment of one side, which, albeit unwillingly, ultimately opts for war as the lesser of two evils. Fisher suggests that it would be beneficial if international conflicts (similar to local disputes) were resolved through some form of judicial system.

Fisher intriguingly states that behind every example of a crisis, one can find a composite effect of a free and forced cycle, starters and trends: “The chair, when tipped, certainly has a tendency to keep rocking – but not forever. And perhaps it is either restarted or put out of rhythm by a new jolt from a dusting housewife” (p. 72).

Indicators signaling the impending crisis in the USA, which went unnoticed, were twofold. Firstly, there wasn’t enough gold to support excessive borrowing, which ultimately “set the stage for the collapse of 1929” (p. 97). Secondly, by the summer of 1928, construction activities, particularly sensitive to fluctuations, began a downward trend. The preceding period of the so-called “New Era”, marked by stagnant commodity prices but a surge in stock prices driven by speculative fervor, abruptly halted with a sudden stock sell-off on the New York Stock Exchange in September 1929. Initiated by British investors, these sell-offs swiftly escalated into a panicked mode. Stock prices plummeted uncontrollably, leading numerous businesses and life savings to ruin. Over-indebtedness was not easy to solve in the conditions of a fall in the general level of prices (deflation): as the dollar’s real value increased, despite nominal repayments, debts didn’t decrease but instead grew in real (which, according to Fisher, was the main problem of the 1929-32 crisis).

What could be the remedies for the economy? Fisher aligns with certain economists of his time who assert that if the equation PT = MV (where price level = P, trade = T, money in circulation = M, velocity of money = V) holds true, it’s imperative for the money in circulation, M, to track the long-term trend of trade, T, to maintain the general price level, P, largely unchanged. The central bank regulates the quantity of money, M, through:

1. the reference interest rate, the mechanism of which he compares to the level of water in a bathtub: “The water in a bathtub is kept constant when the outflow through the waste-pipe exactly equals the inflow through the supply-pipe; but the slightest turn of the spigot from this equilibrium point will, in time, fill or empty the tub. The interest rate acts like the spigot, to fill or empty the country’s reservoir of circulating deposit money” (p. 136);

2. open market operations.

Among the various proposals for measures of financial stability, Fisher describes a measure that could be considered a precursor to loan loss provisions (p. 142). Given that the Federal Reserve system was created in 1913 and that, by then, tens of thousands of bankers—some of them with questionable expertise—comprised the credit market, Fisher’s time was also marked by the development of monetary principles.

Fisher additionally describes the events that preceded the British abandonment of the gold standard in September 1931 and the immediate withdrawal of gold from circulation in America. A debate then emerged regarding whether a superior monetary system is based on the gold standard or fiat money, particularly considering the potential effects of the discovery of new gold deposits or overly simplistic manipulations.

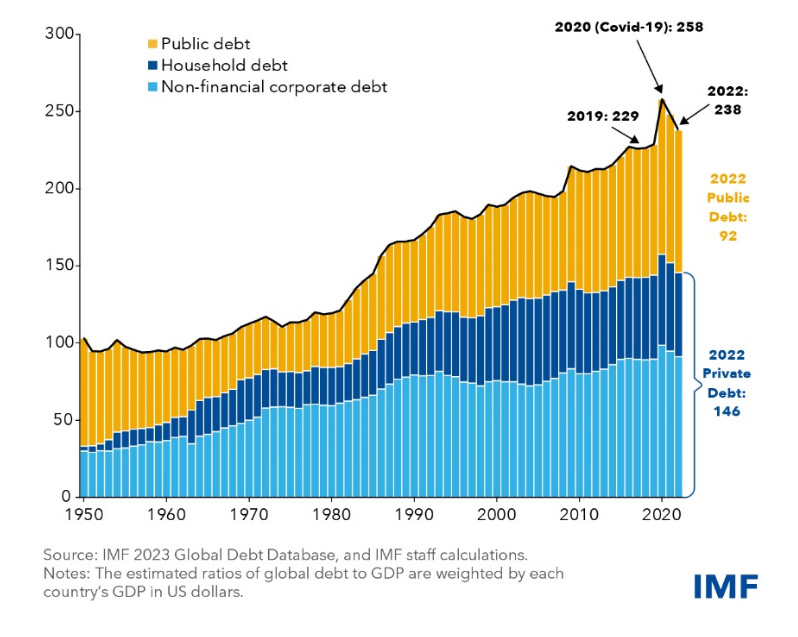

Today, at the end of 2023, similar questions are once again occupying the attention: are we at the turning point of the business cycle, is fiat money stable enough, or are we transitioning to digital money, is the global balance of power disrupted, and is it possible to prevent a global-scale war and subsequent monetary instability? As Fisher states that the negative cycle begins with over-indebtedness, visually analyzing the movement of global debt becomes very informative (Figure: Global Debt (% of GDP)).

Although the presented data’s drawback is the absence of global debt from the financial sector, focusing solely on public, household, and corporate debt, the increasing trend in global debt from 1950 to the present is still noticeable. Over-indebtedness during the pandemic crisis in 2020, aligning with Fisher’s description of unproductive borrowing, indeed did not pose a significant issue, as the debt induced by the pandemic decreased rapidly after its conclusion. Much more worrying is that the global debt is continuously growing, calling into question its sustainability.

Figure: Global Debt (% of GDP)