Economic commentary:

KIRZNER

The capitalist free market has faced criticism for not being economically just. It is particularly interesting to understand how Kirzner, a recognized leader of the Austrian School of Economics, responded to such critics by offering a discovery paradigm. Understanding Kirzner’s explanation of how the market works is essential to properly grasp his views on economic justice and ethics.

Ethics and the Austrian School of Economics

In the tradition of the Austrian School of economics, the doctrine of value-freedom (Wertfreiheit in German) is applied and promoted in scientific work. In the late 19th century, Carl Menger criticized economists of his time for making economic conclusions influenced by moral judgments. In 1909, Max Weber famously referred to the fusion of ethics and scientific work as “the work of the devil” (Kirzner, 1976). Under the influence of Austrian economics, even the neoclassical school eventually embraced the value-free doctrine. Lionel Robbins was among the first neoclassical economists to adopt this approach in the early 1930s (Kirzner, 1976)

Ludwig von Mises also supported the Wertfreiheit doctrine, and his approach to ethics was utilitarian and relativistic. According to Mises, “mortal man” makes decisions about his ultimate goals based on his personal values and judgments. When it comes to the means to achieve these goals, “mortal man” simply needs to ensure that those means are well-suited to reach his intended objective (Mises, 1960). He believed that economics should maintain a neutral stance toward moral principles. Since economics is a positive rather than a normative science, it should not concern itself with ethical questions.

The Volker Fund’s Symposium on Relativism, where Mises expressed his ideas on ethically neutral or value-free economics, was held in 1960, marking a division within the Austrian School of economics: Ludwig von Mises and Hayek on one side and Murray Rothbard and Leo Strauss on the other side (Modugno, 2009, pp. 14). Instead of a subjective approach to values (or relativism), Rothbard and Strauss favoured an objective approach to values (or absolutism). They argued that a universal system of values must exist because man is rational and capable of discerning truth. Rothbard disagreed with the relativist view of ethics: “one problem he sees with it is that it appeals only to subjective values to convince others that the best social system is the market economy”. (Modugno, 2009, pp. 16).

Hazlitt referred to the relativism vs. absolutism dilemma as one of the central issues in ethics (Hazlitt, 1964). Similarly, Hutchison criticized Ludwig von Mises for being a guardian of the Wertfreiheit doctrine on one side while being a promoter of the free market and a strong opponent of state interventionism on the other side. According to Hutchison, these two stances were inconsistent. In response to the critics, Kirzner offered an illustration: “There is, of course, nothing improper about the proponent of a value-laden political position seeking support in the wertfrei conclusions of science. One who values the preservation of life and crusades against cigarette smoking is acting quite properly in citing the conclusions of medical research to the effect that smoking is dangerous to health”. (Kirzner, 1976, pp. 88).

Economic Justice and the Austrian School of Economics

Non-Austrian economists attempted to aggregate individual tastes, preferences and satisfaction within the framework of welfare economics. The idea was to derive synthetic parameters that could be maximized through the implementation of specific economic policies. However, Austrian economists identified a critical drawback to this theory: the aggregation of so many diverse individual pieces of information scattered throughout society is exceedingly challenging, making the achievement of welfare theory’s objectives inefficient (Kirzner, 1976).

To overcome this limitation, Austrian economists proposed a different approach: coordination. Their goal is not to maximize aggregate social welfare but, more modestly, to harmonize individual tastes, preferences, and satisfaction through the coordination of decision-making and action (Kirzner, 1976). The two fundamental pillars of this coordination are specialization and the division of labour, which enhance the efficiency of each participating individual in a market economy. There are, however, three coordination problems, but the market, through its price system, helps to reduce or resolve them (Kirzner, 1963). The following table illustrates these problems and the solutions offered by the market:

| Problems of Coordination | How the Market Solves the Problem |

|---|---|

| Problem 1: Since resources are limited, prioritization is necessary in an economy. Ultimate justice is not necessarily the criterion for setting these priorities. | Solution 1: The market establishes priorities through prices. If equivalent combinations of resources can produce different products (where production costs are the same), the economy prioritizes products that can yield the highest market selling prices. |

| Problem 2: There are multiple methods of production, and the “correct” method needs to be determined. | Solution 2: The “correct” method of production is the least expensive one. |

| Problem 3: There is the issue of determining individual rewards for each of the resource owners. For instance, when a truck driver transports specific goods, the challenge lies in accurately assessing the contributions of the truck driver, the highway, the truck, and other elements to ensure proper compensation forthe work performed. | Solution 3: Resource prices are established on resource markets through the interaction of supply and demand. These resource prices are considered costs. The remaining amount, after compensating resource owners, represents pure entrepreneurial profit. |

Source: Created by the author, based on Kirzner’s (1963), “Market Theory and the Price System”

The challenge of developing an economically just system of rewards for individual resource owners is approached differently by neoclassical economists compared to Austrian economists. Kirzner, often regarded as a leader of the Austrian School of economics following Mises and Hayek, contrasted his views with those of neoclassical economists on this sensitive issue (Kirzner, 1992; Kirzner, 2000; Boettke et al., 2018).

Kirzner’s View on Entrepreneurship, Ethics and Economic Justice

In defending the capitalist distribution of income, John Bates Clark explained that in a static equilibrium, each individual resource owner receives the full value of their marginal productive contribution. Milton Friedman simplified Clark’s ethic, stating, “To each according to what he and the instruments he owns produces” (Friedman, [1962] 2011), or simply put, “what a man has produced”. In the context of static equilibrium, which functions within the framework of perfect competition, there is no concept of pure entrepreneurial profit. Should such profit exist within this context, it would be deemed both ethically and economically unjustified (Kirzner, 1992; Boettke et al., 2018).

Therefore, the ethical notion of “what a man has produced” is insufficient for Kirzner because it does not recognize pure entrepreneurship. In an ethically relevant sense, Kirzner believes that pure entrepreneurship contributes to the entire product, and resources as factors of production may not even be necessary (Kirzner, 1974).

The two ethical implications stem from the concept of “what a man has produced”. The first emphasizes the role of factors of production, while the other places a spotlight on human creativity. These distinct perspectives on capitalist justice are known as the allocation paradigm and the discovery paradigm. The allocation paradigm was prevalent throughout the middle and latter parts of the 20th century and was embraced by mainstream economists. In contrast, the discovery paradigm was not only articulated by Austrian economists but also found support within a lesser-known branch of the Chicago School, including economists such as Buchanan and Coase (Boettke et al., 2018).

Kirzner highlights that many authors fail to acknowledge the significance of human creativity. To emphasize this point, Kirzner (1974) even references a sentence from Knight’s book “Risk, Uncertainty, and Profit” (1921, p. 271) that reads: “Under the enterprise system, a special social class, the business men, direct economic activity: they are in the strict sense the producers, while the great mass of the population merely furnish them with productive services, placing their persons and their property at the disposal of this class; the entrepreneurs also guarantee to those who furnish productive services a fixed remuneration.”

Kirzner is cognizant of the criticisms against market society (Kirzner, [1997] 2000), particularly those associated with the institution of private property, income inequality, and the effects of the price system. However, his primary focus lies on the critiques directed at entrepreneurial profit, which some argue is not justly earned or deserved. These critics contend that the injustice arises from the portion of profit exceeding factor income. Factor income is the compensation received for services provided, such as labour and the return on invested capital. The surplus profit, considered a pure gain, is perceived as originating either from deceit or sheer luck.

In the context of production factors, Kirzner terms entrepreneurial profit as a residual profit. He notes, “The economic problem raised by pure profit is that it seems to be uncaused. We can neither trace it to anyone’s effort, nor to the spontaneous fruitfulness of any productive source. This is so, as we shall emphasize, simply as a matter of sheer definition. To the extent that a receipt can be attributed to the effort of the recipient, it qualifies immediately as a wage (implicit or explicit). To the extent that the receipt can be seen as attributable to the pure spontaneous fruitfulness of an owned asset, it qualifies immediately as property-income component of accounting profit. It is only after all such elements have been filtered out, as we have seen, that we arrive at pure profit.” (Kirzner, 1995, p. 24).

In response to the critics, Kirzner offers a compelling illustration that merits a central place in this economic commentary. He posits that many concerns regarding distributive justice revolve around the question of how to fairly divide an existing “pie”. However, Kirzner highlights that the entrepreneurial act of discovery is what brings this pie into existence. Before the discovery, the pie had no existence. Importantly, entrepreneurial discovery demands no upfront investment of resources; it relies solely on the alertness of the entrepreneur, which is distinctly different from mere luck (Kirzner, [1989] 2016; Kirzner, [1997] 2000; Kirzner, 2000). This illustration succinctly encapsulates the essence of the discovery paradigm.

Kirzner extends his concept of economic justice by drawing from Nozick’s entitlement theory of justice, specifically focusing on Nozick’s idea that voluntary transfers of ownership are legitimate means for just distribution (Kirzner, 1978). Kirzner raises the question of whether involuntary transfers could also be economically just. To address this, he elaborates on the concept of error as a foundation for market exchanges. In a state of market disequilibrium, errorless transactions are rare, according to Kirzner. Conversely, errors are inherent to a state of disequilibrium, and it is these errors that lead to entrepreneurial discoveries: alert entrepreneurs capitalize on mistakes made by other participants in the market.

An example of such an error is a price differential, where a seller is unaware of buyers willing to pay more for their product, while a buyer is unaware of sellers offering the same product at a lower price. The entrepreneur identifies this price differential and profits from it. Is this profit acquisition just? To answer this, Kirzner refers to the arbitrage theory of pure profit. An entrepreneur responds to price differentials as unnoticed profit opportunities, effectively creating or discovering this business opportunity out of thin air, ex nihilo. As such, it rightfully belongs to the entrepreneur (Kirzner, 1995).

Kirzner makes a clear distinction between deliberate errors and genuine errors, operating under the assumption that there is no fraud or deception among market participants. Given these conditions, the majority of market transactions are voluntary, and errors tend to be deliberate due to a general awareness of market risks. In some cases, the costs of gaining knowledge may be high, leading market participants to remain intentionally unaware of better prices on other markets. Genuine errors are not ruled out, as some participants may be entirely unaware of other markets and their conditions. Nevertheless, under the law, completed market transactions remain legally valid (Kirzner, 1978).

Furthermore, Kirzner defines ethical judgment and economic insight as the foundational elements of the free market, forming the basis for economic justice within it. Concerning ethical judgment, Kirzner underscores the “finders-keepers” principle: a resource does not exist until it has been discovered, and the discoverer is entitled to keep what they have found. Economic insight maintains that the discovery of a price differential grants the finder (entrepreneur) the right to retain the profit earned from their discovery. Thus, market transfers are considered just, even in a state of disequilibrium (Kirzner, 1978).

While fraud is explicitly excluded from the study (as Kirzner asserts, “It should be observed that this justification of entrepreneurial alertness to the errors made by others does not extend to the justification of fraud, properly defined. […] Fraud is not covered […] because fraud involves the deceitful inducement of error […] on the basis of which consent is fraudulently obtained” (Kirzner, 1978, p. 20)), he acknowledges that non-fraudulent exploitations of errors by entrepreneurs may raise moral concerns. To illustrate this, Kirzner provides a hypothetical example: Imagine the price of meat is favourable in the market, and Hunter A rents a gun to start a hunting business. He also employs Hunter B, who appears to be exceptionally skilled at hunting. After deducting expenses, such as Hunter B’s wage and the rental cost of the gun, Hunter A earns entrepreneurial profit. However, Hunter B may engage in unethical behaviour, using the same gun (for which Hunter A pays the rental costs) to earn a profit for himself, in contrast to the terms of their agreement. Hunter A may be unaware of Hunter B’s unethical actions or perhaps unable to intervene. Kirzner’s analysis suggests: “What our example has shown is that […] we may have either (but not both) of the two situations. Either A has succeeded in hiring this alertness of B – in which case A is the only entrepreneur […]- or A does not succeed [ …], and B himself captures the opportunities he perceives – in which case B’s alertness is indeed entrepreneurial […]” (Kirzner 1973, page 61 and 62).

Kirzner’s perspective on the justice of capitalism differs from mainstream economist views, as he concludes, “I have argued (1) that the capitalist process consists, very significantly, of innumerable acts […] of entrepreneurial discovery; (2) that acts of discovery are to be sharply distinguished, in terms of positive economics, from acts of deliberate production; (3) that the notion of discovery carries with it, at the level of ethics, specific insights which […] invest the finders-keepers rule with moral weight; so that (4) standard treatments of economic justice under capitalism need to be sharply revised in order to incorporate the full moral reach of the finders-keepers rule” (Kirzner, [1989] 2016, pp. 159).

Critiques of Kirzner’s Views

Kirzner’s ethical “finders-keepers” principle, which he uses to justify entrepreneurial profit, has faced criticism. Burczak, for example, presents two lines of critique (Burczak, 2002).

Firstly, Burczak deems it illegitimate that capitalist enterprises exchange the labour-time of workers for wages. He argues that this illegitimacy arises because a labourer’s work produces something of higher value than the wage received. In this scenario, the labourer is treated not as a responsible human being but as a mere “thing”. Kirzner’s response (Kirzner, 2002) counters this by emphasizing that a labourer is not a mere “thing” and provides an illustration: if the owner of a gun rents out their firearm to another person, the responsibility lies with the owner of the gun, whether the person uses the rented gun for lawful or unlawful purposes. Similarly, a labourer is a responsible human being when offering their labour-time in exchange for a wage.

In the second line of argumentation, Burczak criticizes Kirzner for assuming that everyone has equal opportunities in a market economy to become a pure entrepreneur. Burczak argues that it is impossible to make a profit without prior access to capital, which, in turn, excludes poor individuals who lack equal access to capital compared to wealthier individuals (Burczak, 2002). Kirzner maintains consistency in his response, asserting that anyone who possesses initial capital should not be regarded as a pure entrepreneur. A pure entrepreneur is someone who solely gains profit through their vision or alertness (Kirzner, 2002).

Some argue that Kirzner’s emphasis on the ethical principle of „finders-keepers“ is somewhat overstated. David Gordon, for example, is among those who question it: „Even if Kirzner is right that first finders of objects acquire them, „finders-keepers“ will not directly apply to those who devise new uses for things. These people have not brought anything besides their own ideas into existence: they cannot then claim to own physical assets on the ground that they have created them“ (Gordon, 1991, pp. 122). However, Gordon still acknowledges that the „finders-keepers“ principle has undeniably made a meaningful contribution to the theory of distributive justice.

Kirzner has always been mindful of the provocative nature of the „finders-keepers“ rule, as he once stated, “Once you broaden the concept of finding, the „finders-keepers“ ethic becomes immediately relevant. A theory of justice that considers the role of entrepreneurship will have a place for the „finders-keepers“ ethic, an ethic that would not come into play in an equilibrium view of markets” (Ludwig von Mises Institute, 1997).

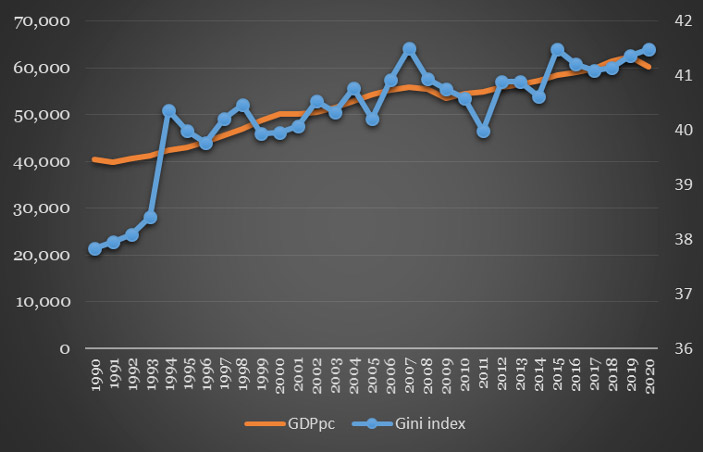

Kirzner’s views inspire a closer examination of two selected American economic indicators using a simple dual x-axis technique for visualizing time series data: GDP per capita and the Gini index. The former reflects the standard of living, while the latter measures income inequality (please refer to Figure: GDP per capita & Gini index, 1990-2020).

Considering the easily observable trends in which the standard of living increases but is accompanied by the growth of income inequality, which indicates that all segments of the population do not benefit equally from the improved standard of living, several questions arise: Are these observed trends the result of „finders-keepers“ principle that is embedded in American society? Are these growth trends in both variables sustainable and what potential social, economic and political consequences could result from this?

Figure: GDP per capita & Gini index, 1990-2020

Source: World Development Indicators and UNU-WIDER WIID (2022) database

Data: GDP per capita, PPP (constant 2017 international USD), scale on the right. Gini index, scale on the left

References

Burczak, T. (2002). A Critique of Kirzner’s Finders-Keepers Defense of Profit. The Review of Austrian Economics, Volume 15, Issue 1, pp. 75–90.

Boettke, P.J., Candela, R. (2017). A social morality for mortals: A review essay of the order of public reason: A theory of freedom and morality in a diverse and bounded world. The Review of Austrian Economics, 2017, Vol.30 (3), pp.365-375.

Friedman, M. ([1962] 2011). Price Theory: A Provisional Text. Martino Fine Books. 2011 Reprint of 1962 edition.

Gordon, D. (1991). Book Review: Kirzner (1989). Discovery, Capitalism, and Distributive Justice. The Review of Austrian Economics, Vol. 5, Issue 1, pp. 117-122.

Hazlitt, H. (1964). The Foundations of Morality. The Foundation for Economic Education. Irvington-on-Hudson, New York 10533.

Nozick, R. (1974). Anarchy, State, and Utopia. New York: Basic Books, 1974.

Kirzner, I. (1963). Market Theory and the Price System. Van Nostrand Series in Business Administration And Economics.

Kirzner, I. (1973). Market Process versus Market Equilibrium, Chapter 1 / The Entrepreneur, Chapter 2 in: Competition and Entrepreneurship, Chicago: The University of Chicago Press, pp. 1-87

Kirzner, I. (1974). Producer, Entrepreneur and the Right to Property. Reason Papers, A Journal of Interdisciplinary Normative Studies, Issue no. 1, pp. 1-17.

Kirzner, I. (1976). Philosophical and Ethical Implications of Austrian Economics. The Foundations of Modern Austrian Economics. Edited with an Introduction by Edwin G. Dolan. Sheed & Ward, Inc. Subsidiary of Universal Press Syndicate. Kansas City. pp. 75-88.

Kirzner, I. (1978). Entrepreneurship, Entitlement, and Economic Justice. Eastern Economic Journal, Vol. 4, Issue 1, pp. 9-25.

Kirzner, I. (1992). The Meaning of Market Process. Essays in the Development of Austrian Economics. Routledge. London and New York.

Kirzner, I. (1995). Profits and Morality. Chapter 2: The Nature of Profits: Some Economic Insights and Their Ethical Implications. Book Profits and Morality was edited by Rizzo, M. and Cowan, R. The University of Chicago Press Books.

Kirzner, I. ([1997] 2000). How Markets Work. Disequilibrium, Entrepreneurship and Discovery. The Institute of Economic Affairs, London. First published in June 1997. Second Impression 2000.

Kirzner, I. (2000). The Driving Force of the Market. Essays in Austrian Economics. Routledge. London.

Kirzner, I. (2002). Comment on “A Critique of Kirzner’s Finders-Keepers Defense of Profit”. The Review of Austrian Economics, Volume 15, Issue 1, pp. 91–94

Kirzner, I. (2002). Comment on “A Critique of Kirzner’s Finders-Keepers Defense of Profit”. The Review of Austrian Economics, Volume 15, Issue 1, pp. 91–94

Kirzner, I. ([1989] 2016). Discovery, Capitalism, and Distributive Justice (Collected Works of M. Kirzner). Edited and with an Introduction by Peter J. Boettke and Frédéric Sautet. Liberty Fund. Originally published 1989.

Knight, F. ([1921] 1964). Risk, Uncertainty and Profit. Reprints of Economic Classics. Reprint of 1921 Edition. Sentry press, New York

Ludwig von Mises Institute (1997). The Kirznerian Way: An Interview with M. Kirzner. Austrian Economics Newsletter, Vol. 17, No. 1 (Spring 1997). Accessed on: https://mises.org/library/kirznerian-way-interview-israel-m-kirzner [14.02.2019]

Mises, L. (1960). Epistemological Relativism in the Science of Human Action. This paper was originally presented at the Volker Fund’s Symposium on Relativism, 1960.] The conference papers were published in H. Schoeck and J.W. Wiggins, eds., Relativism and the Study of Man. Princton, N.J.: D. Van Nostrand, 196. Accessed on: https://mises.org/library/epistemological-relativism-sciences-human-action [13.02.2019]

Modugno, R. (2009). Murray N. Rothbard vs. the Philosophers: Unpublished Writings on Hayek, Mises, Strauss, and Polanyi. Ludwig von Mises Institute. Accessed on: https://mises.org/library/murray-n-rothbard-vs-philosophers-unpublished-writings-hayek-mises-strauss-and-polanyi [14.02.2019]

UNU-WIDER, World Income Inequality Database (WIID). Version 30 June 2022. https://doi.org/10.35188/UNU-WIDER/WIID-300622