Economic commentary:

VÉRONIQUE RICHES FLORES

With a career that included a tenure at an independent research center OFCE – Observatoire français des conjoncture économique (French Economic Observatory) from 1986 to 1990 and the role of chief economist at a prominent French investment bank, Riches Flores has demonstrated an exceptional understanding of economic conditions, particularly in the United Kingdom.

Her 1992 book, “L’économie britannique depuis 1945” presents a captivating analysis of the socio-economic conditions leading up to the era of Thatcherism and the era itself, making it a compelling exploration of this period. In its opening sentences, it becomes evident that this is a period marked by the rapid ‘confiscation’ of supremacy by the USA from the UK on the international stage.

The described political-economic historical events and trends are complemented by statistically analyzed comparative data, frequently centered on the UK and the USA, while also encompassing other developed economies like France and Germany.

In 1945, the UK Prime Minister Attlee faced difficult negotiations with the USA. Initial hopes of receiving USD 5 billion in aid and interest-free loans from the USA eventually gave way to the prime minister’s concession. In exchange for a USD 3.7 billion loan at a 2% annual interest rate, the British pound became freely convertible to the dollar. This compromise was often described as “exchanging the British Empire for a mere pack of cigarettes”. The introduction of free convertibility on July 15 turned into a fiasco, leading to significant capital outflows and lasting until August 20, 1947.

Riches Flores vividly explains the challenges the UK society went through, trying to regain its global dominance. Traditionally an industrial powerhouse in the past, the UK faced a constant decline in its industry. The acquisition of independence of its former colonies in the post-war period contributed to the complication of its international image.

Even the entry of the UK into the Common Market (of the EU) was not initially successful. The specifics of its agriculture, the policy of cheap food, were the reason why French President General de Gaulle vetoed its accession in 1963 and 1967. It was only for the third time that the UK managed to access the Common Market, and the subsequent increase in prices led to a wave of dissatisfaction among the population. Riches Flores explains that the increase in prices in the UK in 1973 was due to the oil shock, but it was perceived to be associated with access to the Common Market.

Successive governments led by both the Conservative and Labor parties applied economic policies predominantly aligned with Keynesian principles. The shift in economic policy from Keynesianism to monetarism commenced during Jim Callaghan’s government (1976 to 1979) and swiftly evolved into neoliberalism with disruptive effects under the leadership of Margaret Thatcher (1979 to 1990).

Thatcherism was characterized by the privatization of state assets, massive market liberalization and deregulation, especially in the field of finance. Although the industry has not regained its former glory, new sectors have emerged as the leaders of the UK economy. Reforms of the financial sector led to the prestige of the City of London, and oil companies became national and international giants.

However, high inflation remained a persistent challenge that Margaret Thatcher’s government did not resolve. When she assumed office as prime minister, annual inflation stood at 10.3%, and it was 10.9% when she concluded her mandate. According to Riches Flores, this failure could be attributed to two reasons. First, the poor functioning of the labor market, as real wages had an upward trend, while a deficient education system, early school leaving, unfavorable migration and stagnation of the active workforce resulted in a lack of skilled labor. Second, higher wages further boosted demand as the population, eager to catch up with the consumption patterns of developed economies, sought to make up for previous lags.

After the shock economic therapy associated with Thatcherism in the 1980s, by the early 1990s, the UK had come to terms with the fact that it was no longer a supreme global power but had evolved into a mature and well-developed world economy.

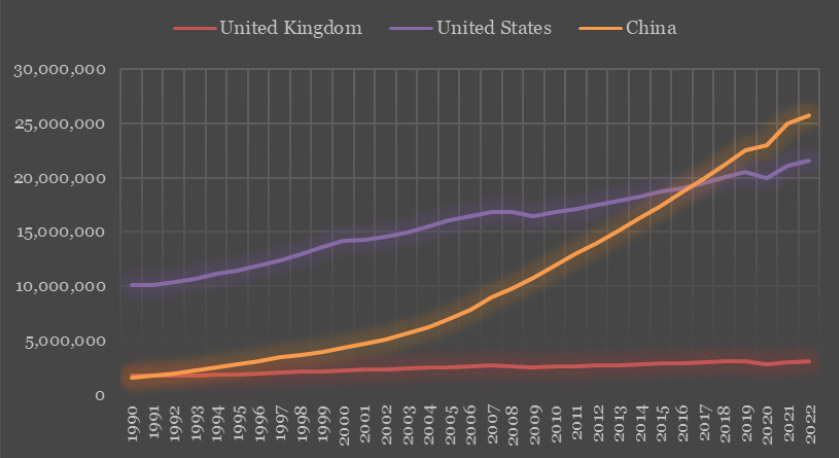

This interesting book by Riches Flores encourages more thinking. At the time of writing this commentary in September 2023, the question arises: Are we witnessing the beginning of a period in which a rapid ‘confiscation’ of supremacy is once again taking place? If we were to use only one criterion for comparison, let it be Gross Domestic Product (GDP) measured using Purchasing Power Parity (PPP) in US Dollars (USD), adjusted for inflation, and expressed in terms of 2017 price levels. This metric provides a way to compare the economic output of different countries, taking into account differences in living costs and inflation rates (please refer to Figure: Real GDP in USD millions, 1990-2022). The data demonstrates the rapid economic growth and progression of the Chinese economy. Two key milestones stand out: in the early 1990s, China’s economy surpassed that of the United Kingdom, and by 2017, it had also surpassed the economy of the United States.

Only time will reveal the answers to the important questions, what these significant changes mean for other countries and whether the transition of global dominance will take place peacefully.

Figure: Real GDP in USD millions, 1990-2022

Source: World Development Indicators.

Data: GDP PPP in international USD (constant 2017)